July 26, 2022

One of the Deep Tech’s largest and most well-recognised verticals, the sector offers promising perspectives both on defence and commercial applications. Also in Italy, which hosts a flourishing and varied ecosystem

If you could have any superpower, what would you like it to be? For many people, the answer would be ‘the ability to fly’. This is probably because as humans we have always been obsessed with ‘flying,’ with mentions of flying chariots, objects, and even personal wings, in many historical texts. Funnily enough, to deliver letters faster, people in the past have even resorted to using pigeons. Even now, when airplanes and helicopters have become readily available as means of transport, many still dream of being able to just soar the skies whenever they want in their personal vehicles of choice. ‘Space’ is another realm that has always intrigued the consciousness of mankind. It is as if the more we know, the less we realise we know. Notwithstanding that, as we explore, we have also been able to harness its properties to create resources for our technological betterment, for example, taking inspiration from the moon as a satellite and then creating our own mechanical ones.

The combined fascination with the two areas above has led to the birth of the sector Aerospace, which is in fact, a term used to collectively refer to: Atmosphere and Outer Space. The general industry deals with anything related to vehicular flight within and beyond Earth’s atmosphere, making it one of the largest and most influential industries with both private and public applications. It is, in fact, one of the Deep Tech sector’s largest and most well-recognised verticals.

Deep Tech companies produce nothing short of innovative discoveries, and therefore, for an Aerospace company to count as part of the deep tech sector, the product in development cannot be the conventional commercial aircraft or a new kind of related service. Whether a drone or satellite, the underlying solution should be as inimitable as possible while breaking some sort of technical or scientific boundary.

Investors are taking notice

We can divide recent investments into two themed verticals: Drones and Satellites. In terms of the sub-sector drones, in particular unmanned air taxis and cargo drones, $3.8 billion of investment was performed in 2021 (+216.67% from 2020) according to a report by Phystech Ventures (an early-stage deep tech VC firm). This has led to the development of no fewer than 170 different e-VTOLs by almost 130 different countries.

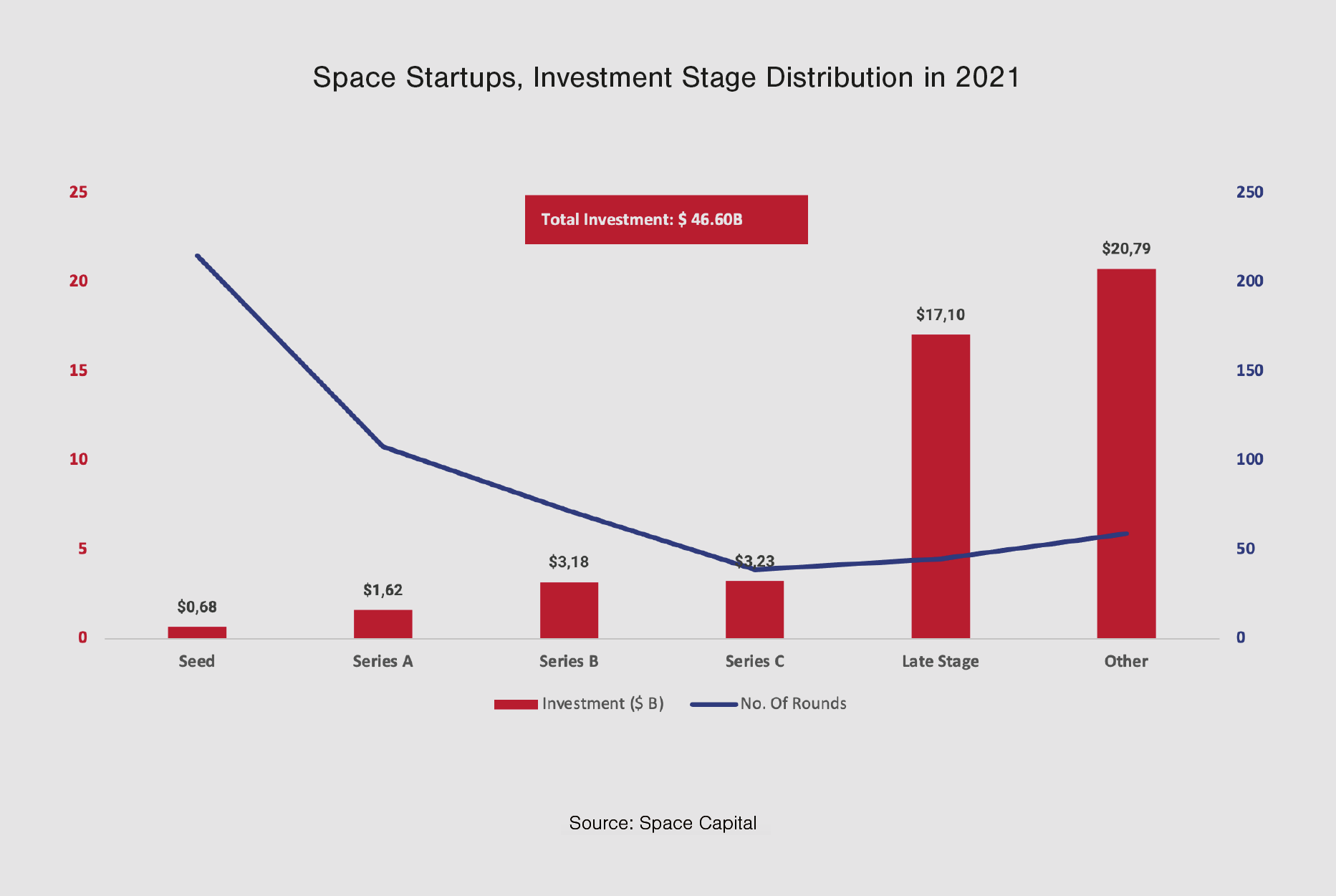

In terms of the sub-sector satellites, in 2021, $17 billion (+ 86.81% from 2020) was invested into 328 different space companies, as reported by Space Capital (a Venture Capital firm). The United States, understandably so, had the highest percentage of investments (62%), followed by Japan (30%), and then Italy (2%). Even though these 328 companies consisted of different space-based products, most of the investment flowed into one segment: launch and satellite (95%); the rest went into biospheres.

Governments and international institutions worldwide, mainly European, are also noticing this sector’s potential. The European Space program (already operating the likes of Copernicus Egnos and Galileo), with a budget of $14.67 billion spanning seven years from 2021 onwards, is one such example. It intends to fund applications based on services such as navigation and timing, space surveillance and tracking, and effective satellite communications.

Recently, individual countries like Germany, France and Luxembourg have also founded joint institutions like Euro2Moon (October 2021), to promote the exploitation of lunar-surface-based resources. Italy’s very familiar National Recovery and Resilience Plan (PNRR) has also set aside €1.49 billion to focus, among others, on satellite communication, space access, earth observation, and in-orbit economy applications.

This high investment has ultimately powered Aerospace companies to produce products spanning different industries and, therefore, customers. The applications can be divided into two broad contrasting categories, commercial, and defence.

Commercial applications

Most commercial Aerospace applications have a futuristic ring to them, something straight out of science fiction novels and movies. They tend to be something that most people think of when asked about the future of technology. These Aerospace companies develop products with applications striving to increase human convenience. The sub-sectors attracting the most attention are:

- Mobility: The list from something that comes to everyone’s mind when thinking of aerospace: flying cars. They have been mentioned in the media since as early as 1890, almost as far back as the invention of actual grounded cars (1885). However, it’s only now that we have come close to fulfilling this age-old vision, through drones. Innovators like Volocopter (with a valuation of $1.7 billion), an all-electric air taxi manufacturer, is planning to launch this service soon. Even one of Cliffs’ portfolio companies (fund of Milano Investment Partners SGR), Orb Aerospace is in the early stages of developing an electric aircraft providing the freedom to fly, for everyone.

- Logistics: Cargo drones have the capability of solving massive logistical problems. While many companies are focusing on last-mile delivery, there is also an enormous opportunity in the middle-mile delivery sector. Both solutions can drastically increase and aid express delivery services, decrease cost and time needed by current solutions, elevating the quality of life of more than a billion people worldwide. Cliffs’ portfolio company (fund of Milano Investment Partners SGR), Elroy Air, is one such example with the mission to enable same-day shipping.

- Increased connectivity for Remote Areas: Automated unmanned aerial vehicles can help provide better connectivity and internet access to faraway rural areas (another Cliffs’ portfolio company, Skydweller Aero, is developing perpetually flying solar drones and has similar objectives as one of its main applications). As a matter of fact, almost 20 companies globally, including Amazon, Boeing, Astra, and Telesat, are planning to launch around 38,000 total satellites to provide broadband services to remote areas.

- Healthcare & Emergency: Drones are increasingly being used to provide rapid healthcare access, for example, Zipline, a drone delivery startup (with a €2.75 billion valuation), has made a name for itself in African countries like Rwanda and Ghana where it used its drones to transport vaccinations, blood, and life-saving medications. Emergency responders are also already using drones to aid trapped people in need, especially in dangerous situations. In some cases, they have helped to prevent disasters altogether.

- High-Risk Jobs: Drones can help eliminate the risk of exposure to chemicals, harmful substances, and falling from heights (one of the leading causes of death in workplaces) in many jobs. Companies such as BASF, Royal Dutch Shell, AT&T, and Dow Inc. have already begun using them. Drones are saving these companies downtime, cost, and productivity on their maintenance personnel.

- Geospatial Imagery: With the rise in demand for locationbased technologies and drones for surveillance (already being used in agriculture, GPS, crime mapping, road traffic mapping, etc.), geospatial imagery providing satellites are forecasted to witness immense growth. With the major autopilot evolution in cars and airspace, automotive companies like the Chinese automaker Geely, are looking to launch their own satellites.

- Space travel: Private company SpaceX made history in 2020 when it sent humans to space. Since then, there has been an elevated hype around space travel. Companies like Boeing, Blue Origin, Virgin Galactic, and even NASA (in collaboration with SpaceX), are enhancing their efforts to sustainably bring private citizens to space at scale. This sector will create an opportunity through space tourism while increasing the demand for rocket manufacturing companies.

Defence applications

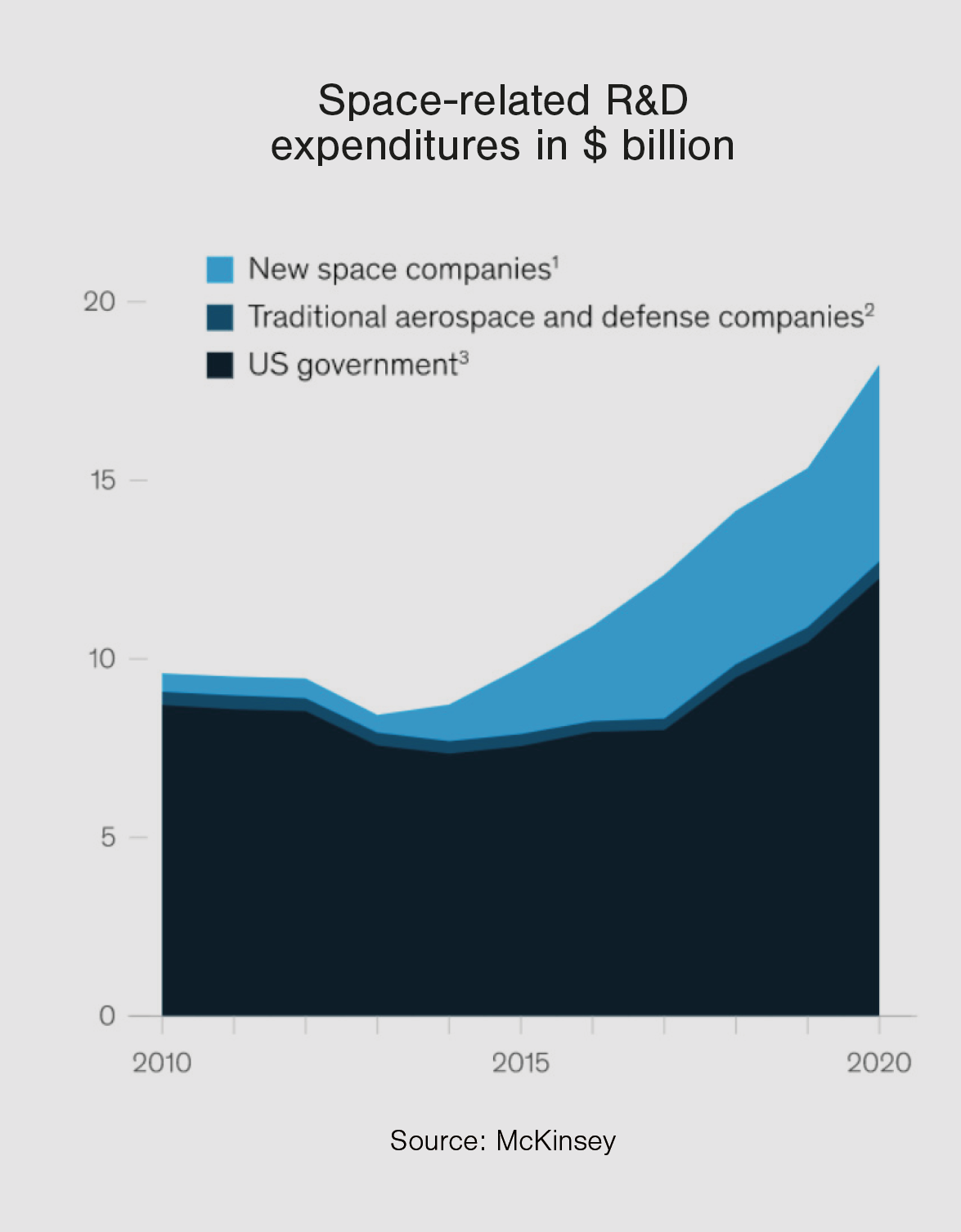

While catering to a more conventional commercial market, applications like surveillance, logistics, and geospatial imagery can also fulfill and create demand for a different sector, military and defence. A significant funding source for private aerospace companies has been international governments (mainly the U.S. Federal Government). For example, according to an analysis by financial consulting firm McKinsey, out of the around $18 billion spent on space-related R&D expenditure in 2020, the U.S. Federal Government spent $12 billion. And now, especially with the current political environment referring to the Russian-Ukrainian war, many European countries (and beyond) who had wholly forsaken the idea of a high defence expenditure are forced to reevaluate. For example, Germany, which has resisted pressure for a long time, is now planning to increase its defence spending to 2% of its economic output (in addition to $100 billion) compared to 1.53% in 2021.

This is welcome news for Aerospace companies worldwide, but especially for European companies (European countries are increasingly planning to increase their spending on ‘made in Europe’ defence products), who are developing drones for operations like reconnaissance to provide battlefield intelligence, logistics to deliver essential cargo, and carrying out tasks that can be deemed as potentially dangerous.

The European Union has also already launched several programs such as EuroMale drones (Medium Altitude Long Endurance Remotely Piloted Aircraft System) and Temptest fighter jet project (sixthgeneration fighter jet). Moreover, one of the projects the U.S. Department of Defence recently supported is Anduril, a developer of long flying autonomous air systems all connected through Artificial Intelligence, which just raised $450 million at a $4.6 billion valuation.

Italy as a hub for Aerospace endeavours

Speaking of European Aerospace companies receiving a lot of attention, it might be surprising for some readers to find out that the Italian Aerospace and Defence industry ranks amongst the top 10 worldwide, with 300 SMEs and five regional players. The applications, of course, range from both military and commercial uses. The sector in Italy generates around €13 billion in revenues and is complemented by a highly skilled workforce of 64,000 employees. The ecosystem consists of many well-recognised international organisations with complex systems, encouraging small Italian Aerospace SME companies focused on the downstream and upstream activities of the supply chain. Leonardo, the Italian multinational company, and the eighth largest defence contractor globally, supports 52 Italian sites and supplies from 4,000 Italian SME suppliers.

D-Orbit is another such company that has become a leader in space logistics and orbital transportation services, after only being founded in 2011. The organization has already delivered more than 70 payloads into space.

The Italian Space Agency (ASI) also has a long history of bilateral cooperation with other international space agencies. NASA and ASI have traditionally been on many profitable space missions. The successful mission in December 2021, IXPE (Imaging X-ray Polarimetry Explorer satellite), born out of the two agencies’ successful partnership is one such recent example. Italy is also involved in EU programs such as GMES and Galileo, putting it on the third position in terms of contribution to the European Space Agency.

A promising sector

In the past, satellite technology has already changed our lives with things we now consider mundane like mobile phones, weather forecasts, credit card transactions, GPS, etc. This is just the tip of the iceberg. As aerospace technologies develop, ordinary people will be able to access a lifestyle with even more luxury and ease. Same-day deliveries, air taxis, even better internet connection and remote access; enhanced safety, more food security, and perhaps even space travel (for everybody), one day.

It should be said that very clearly, inventions in the aerospace sector aid many commercial applications. However, they can be hard to distinguish from and are part of the technological progress that often criticised military and defence spending has brought. With the ever-changing geopolitical environment, perhaps both applications could be something useful and ultimately lead to a better future. Nevertheless, we hope that the Venture Capital industry will enhance their efforts in doing their part to accelerate this much needed technological progress. Who knows, one day the industry might help aerospace companies develop another beloved superpower, time travel. It will also be interesting to track the Italian Aerospace industry’s progress over the next few years and celebrate achievements that would make the country proud and further its presence as one of the most scientifically advanced economies in the world.